More Paper in California: An Evaluation of Documentation Reforms in State Court

Abhay Aneja, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamurthy, and Manisha Padi • July 15, 2024

When a consumer can’t repay a debt, their creditor sometimes assigns that debt to a third party to collect on their behalf or sells the right to collect to a debt buyer. These third-party creditors play a central role in the debt collection industry. However, inadequate information and documentation transferred during the debt assignment and collection process has led to numerous abuses, including attempts to collect debts not owed, from the wrong person, for the wrong amount, or without legal basis of ownership. The California Fair Debt Buying Practices Act (CFDBPA), enacted in 2014, aimed to address these issues by requiring debt buyers to have certain information on hand before attempting to collect or sue individuals for nonpayment of a debt.

CFDBPA Requirements

The California Fair Debt Buying Practices Act of 2013 requires that debt buyers:

(1) possess certain documents and information before contacting a consumer,

(2) make certain specific allegations in the complaint if they sue and attach documentation of the debt to the complaint, and

(3) provide business records in support of the complaint’s allegations and a sworn declaration of their authenticity before obtaining a default judgment.

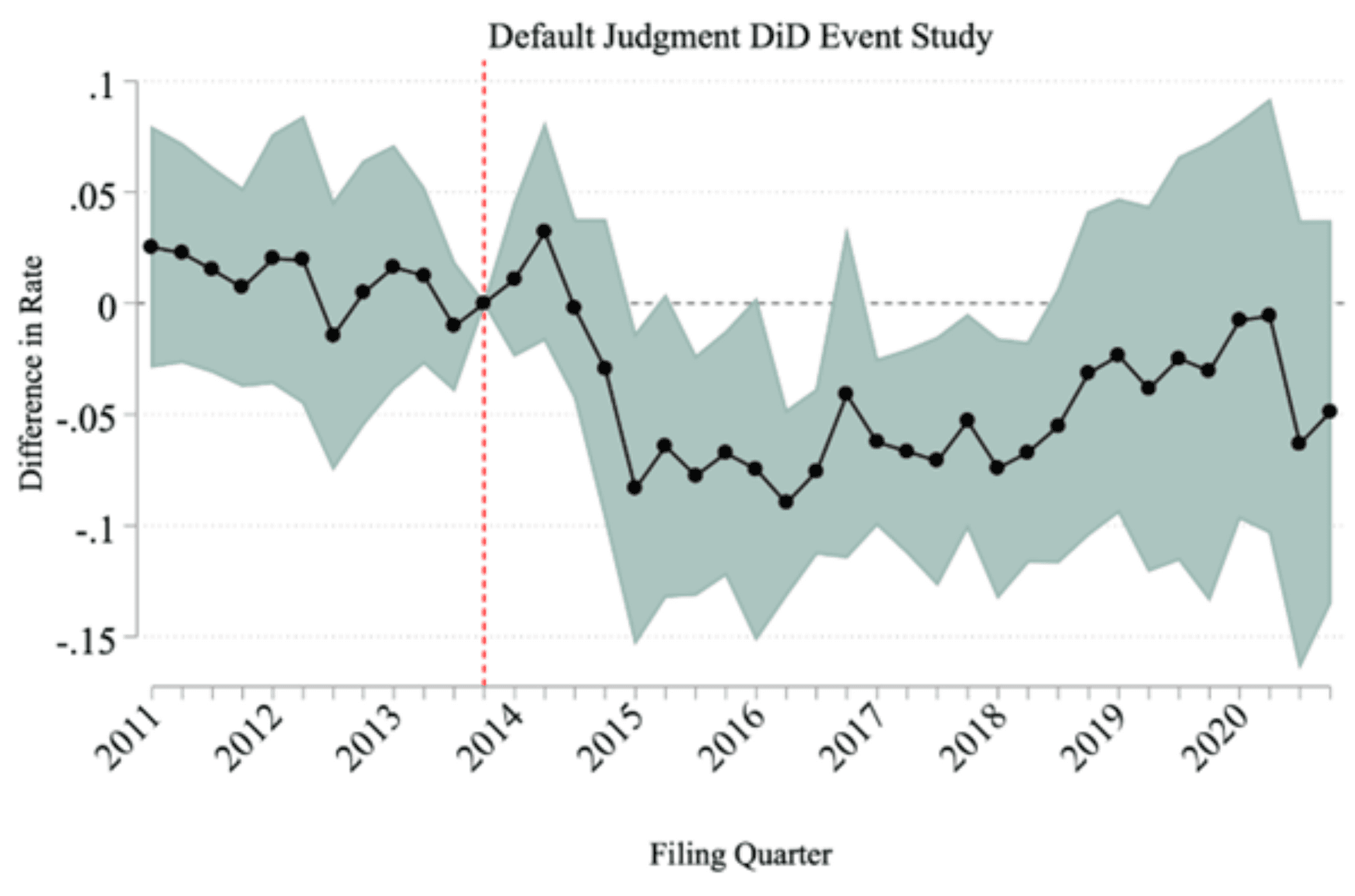

In this Report, researchers from the Debt Collection Lab and at the University of California Berkeley School of Law use an event study design to estimate the causal effect of the CFDBPA on court outcomes using a dataset of over 1.6 million court cases filed in 16 California counties between 2011 and 2020. The CFDBPA affected several court outcomes, although researchers do not find evidence that it impacted the number of cases filed or the value of the cases.

Researchers found a drop in the rate of default judgments entered in favor of third- party creditors compared to original creditors after the legislative reforms, indicating that, at least at first, fewer individuals sued by entities affected by the law a positive impact for California consumers. After the CFDBPA, defendants in cases involving third-party creditors were less likely to experience a default judgment than those sued consumers sued by the company from which they had borrowed money or bought goods or services (the original creditor). The difference in the rate of default judgments between third and first-party creditors fell by 7 percentage points. This is 14% of the overall average default judgment rate of 49% among all cases filed.

On average, cases filed by third-party creditors took 10 weeks longer to reach a judgment post- CFDBPA. This is a significant delay—24% of the average time to judgment of 42 weeks.

Researchers found that the CFDBPA did not significantly affect the likelihood that defendants responded to lawsuits. The average response rate remained low (8%) indicating that the law’s requirements did not lead more defendants to engage in the legal process. However, the CFDBPA increased the rate of personal service by third-party creditors on their defendants. The difference in the proportion of cases filed by third-party creditors in which a proof of service was filed asserting that the defendant was served versus cases filed by original creditors increased by approximately 5 percentage points after the CFDBPA went into effect.

Researchers also surveyed court personnel to learn about how judges and court administrators perceived the impacts of the CFDBPA. In response to a question asking respondents to rank whether default judgments against consumer defendants a problem in the court was they worked in, the majority of respondents (7) responded that they were “neutral” on the topic or that it was “slightly an issue” or “not an issue.” One responded that it was “moderately an issue” and two that it was a “pressing issue.”

California is one of several states that have enacted documentation laws, and almost no two laws are the same. Although this law did not impact the overall rate of filings, the drop in the rate of default judgments indicates a positive outcome from these reforms. The change in default judgment rate shines a light on the important role that courts play in ensuring that third-party creditors are in compliance with the law.