More Paper in Connecticut: An Evaluation of Documentation Reforms in State Court

Abhay Aneja, Julia Byeon, Jacqueline Cope, Luis Faundez, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamurthy, and Manisha Padi • August 09, 2024

This report examines the impact of Connecticut’s debt documentation reforms on debt collection litigation in state court, using data obtained from the court spanning 2010- 2022 and examining reforms implemented in 2011, 2014, and 2016. The authors use a difference-in-difference design to estimate the causal impacts of the 2014 superior court rule on outcomes like filing rates, defendant representation, response rates, default judgment rates, and filings of writs of execution. The authors find that the reforms in superior court made a difference on several important outcomes, but also find widespread noncompliance with documentation requirements in small claims court. Despite failure to meet the documentation requirements, the court granted default judgments in most noncompliant cases. The report contains some recommendations to Connecticut courts.

Debt collection lawsuits have inundated civil courts nationwide, often resulting in default judgments and severe financial consequences for defendants. Concerns about abuses due to incomplete evidence prompted Connecticut to strengthen documentation requirements starting in 2011, mandating comprehensive documentation from plaintiffs. This report examines the impact of Connecticut’s debt documentation reforms on debt collection litigation in state court, focusing on the period from 2010 to 2022. Our analysis highlights significant changes in court processes and case outcomes due to enhanced evidentiary standards. Additionally, we present findings from a compliance review of debt buyer lawsuits in small claims court between 2021-2022, revealing widespread noncompliance with documentation requirements.

Key Findings

Connecticut Superior Court DiD Analysis

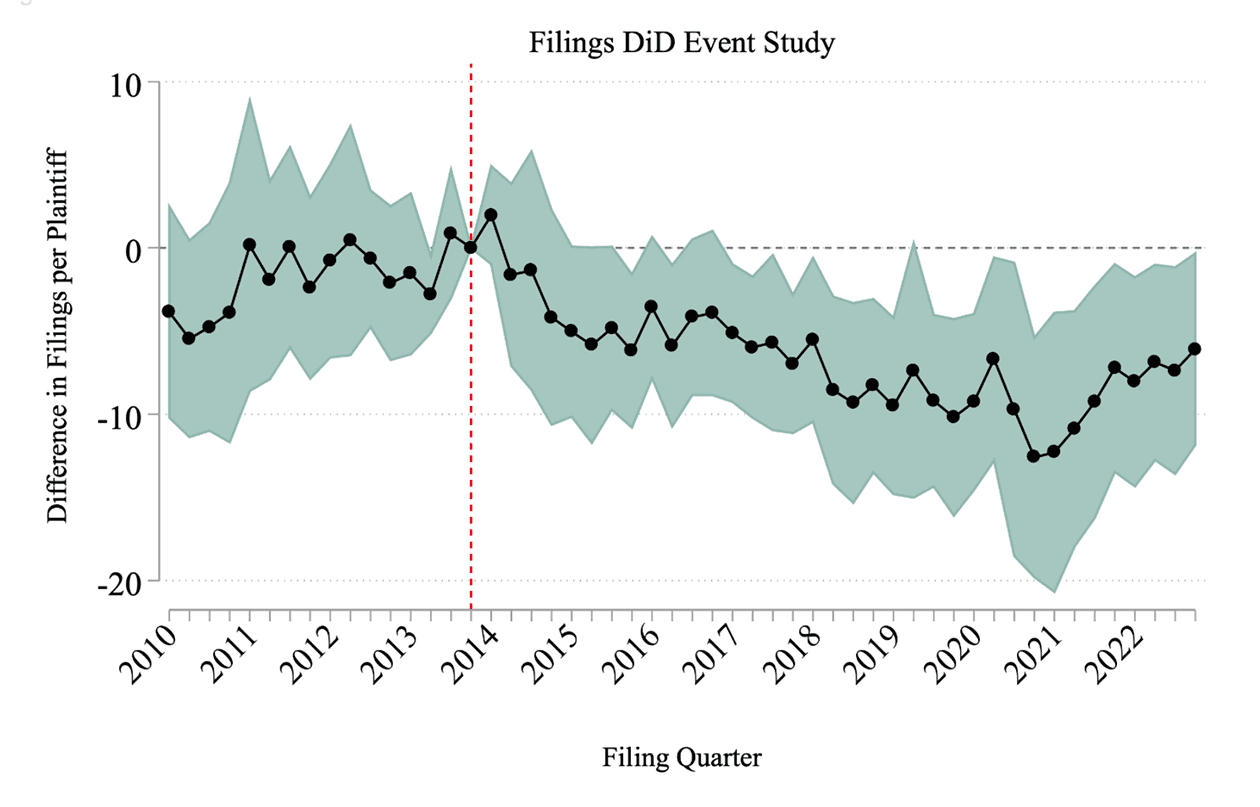

We use a difference-in-differences (DiD) approach to assess the impact of 2014 changes to the superior court rules on court outcomes such as filings and default judgments. These rule changes required third-party plaintiffs to provide evidence of the debt (through a copy of original debt contract and account statements), the amount of the debt (through itemization and explanation of fees and account statements), and ownership of the debt (through bills of sale and specific testimonial evidence). We found:

Drop in Filings by Third-Party Plaintiffs: The reforms led to a decrease of approximately 10 filings per quarter by third-party plaintiffs relative to first-party plaintiffs, suggesting that the heightened documentation requirements may have deterred meritless lawsuits.

Defendant Attorney Representation and Response Rates: The reforms did not significantly affect the rate at which defendants were represented by an attorney, nor can we conclude that they affected defendant response rates. An average of 16% of defendants responded to the debt collection suits during the period analyzed. An average of 8.5% were represented by counsel at some point during the suit while all third-party plaintiffs were represented by counsel.

Amount in Controversy and Writs of Execution: The 2014 rules did not systematically affect the difference in amount in controversy between first- and third-party creditors; however, the filing of writs of execution by third-party plaintiffs decreased by approximately 15 percentage points relative to original creditor plaintiffs after the 2014 reform, down by almost half of the average writ of execution rate of 33% among all cases. Enhanced evidentiary standards may have made it more challenging to enforce judgments without proper documentation. On the other hand, the documentation requirements may have motivated consumers to resolve the matter by payments, rather than risk a writ of execution.

Time to Judgment and Default Judgment Rates: The reforms did not significantly impact the time to judgment or default judgment rates, indicating that the overall pace of case resolution and likelihood of default judgments among cases filed remained consistent.

Review of Compliance with Documentation Requirements in Connecticut Small Claims

In addition to the DiD analysis, we reviewed 88 randomly selected small claims lawsuits filed by debt buyers in Connecticut between 2021-2022 to identify whether filers included all required documentation of ownership of the debt. We did not find a single case where the plaintiff debt buyer complied with all the documentation requirements. Although it is a small sample, because it is random and the effect size is so large, we can estimate that the actual probability that debt buyers are fully compliant in a larger sample would be smaller than 5%.

Despite the noncompliance, in most cases the debt buyer obtained a default judgment. This is a failure of plaintiff compliance, but responsibility also lies with the courts as—per the rules and statute, judgments are not supposed to have been entered in these cases.

Key areas of non-compliance included:

- All but one plaintiff failed to attach a copy of the contract as required by court rule.

- No plaintiff filed an affidavit that included a statement about the statute of limitations as required by court rule.

- 74% of plaintiffs filed affidavits that did not meet statutory requirements regarding listing the contact information of previous debt buyers and dates of purchase.

The reforms may have successfully improved the quality and fairness of debt collection litigation by reducing the number of filings unsupported by the required documentation and influencing certain procedural behaviors in superior court. However, the compliance review highlights significant gaps in adherence to documentation requirements, raising concerns about the integrity of the debt collection process in Connecticut.

We urge the Connecticut judiciary to implement audits and multiple points of review to ensure that these errors are caught quickly. We propose that for cases where judgment has already been entered, upon application for a writ of execution, the judge review case documents for compliance with documentation requirements, and not issue a writ of execution if the plaintiff did not comply with the court rules and applicable law.