More Paper in Texas: An Evaluation of Documentation Reforms in State Court

Abhay Aneja, Julia Byeon, Luis Faundez, Doug A. Lewis, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamur, and Manisha Padi • September 06, 2024

As American consumer debt has grown to unprecedented levels over the past several decades, by 2023, third-party debt collection has transformed into a $17.9 billion dollar industry. Central to the growth of this industry have been debt buyers, who purchase delinquent debts from original creditors and collect through mail, phone, digital communications, and ultimately, lawsuits. These suits dominate state civil courts across the country. The glut of debt collection lawsuits has given rise to concerns among consumer advocates and defendants.

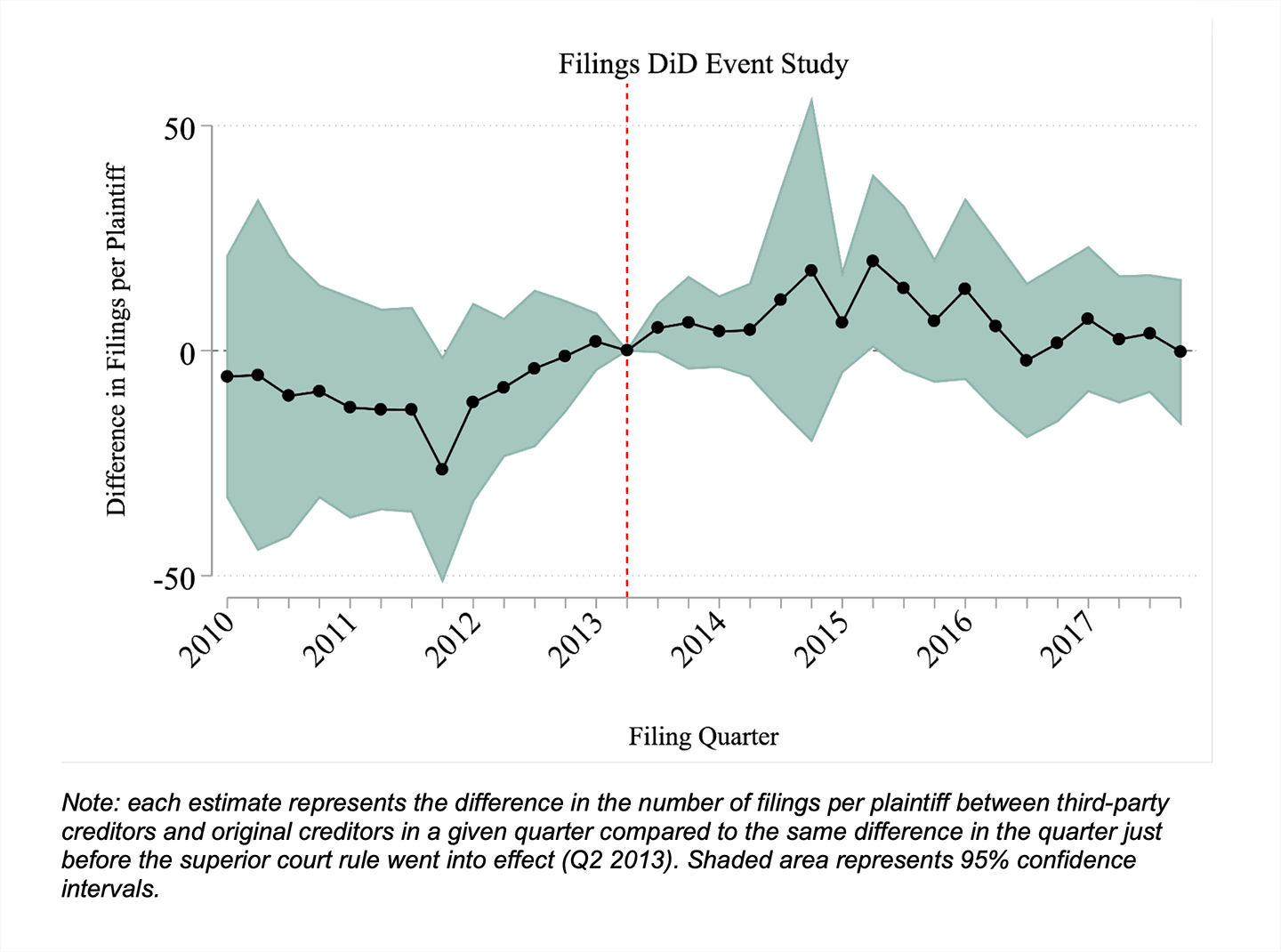

Defendants face significant losses from collections actions filed with inadequate documentation. Without, for example, proof of the debtor’s identity and payment history, an itemization of the amount due, evidence that the debt has not passed its statute of limitations, or evidence that the buyer has acquired the consumer’s account through an appropriate chain of title, debt buyers may contact or even sue consumers for debts they do not owe. These debts are owed by someone else, are for the wrong amount, were already settled or paid, are results of identity theft, or have long passed their statutes of limitations. The issue has been repeatedly documented by regulatory bodies, researchers, journalists, and consumer advocates. Tellingly, for over a decade, the predominant consumer complaint made to the Consumer Financial Protection Bureau regarding debt collection has been “attempts to collect debt not owed.” In 2013, Texas implemented Rules 508.2 and 508.3, reforming court rules that specified the documentation required by debt collectors to file and obtain judgments in state courts. The rules imposed additional burdens on third-party collectors, relative to original collectors. The dual aims of these rules were to protect debtors against abusive collection practices while simultaneously increasing efficiency of collection for debt collectors with full documentation. This report uses an event study design to causally infer the effect of the Texas rule changes as applicable to third-party collectors, relative to original creditors. We study court outcomes, based on a dataset of nearly 175,000 court cases filed in Harris County, Texas between 2010 and 2017.

We show that the Texas documentation rules had mixed impacts on court outcomes. We find that:

- The rules did not significantly impact the number of debt collection filings.

- The fraction of defendants facing third-party debt collection actions that were represented by an attorney decreased relative to those facing original creditors after the Texas rule change. This decrease was progressive and by 2017, the attorney representation rate for defendants sued by third-party creditors was 5 percentage points lower relative to defendants sued by original creditors, which is approximately 62% of the average attorney representation rate during the period studied. The law may have influenced the availability or willingness of attorneys to represent these defendants, and that defendants may have been assisted by legal aid programs or self-help centers (this limited-scope assistance is not captured in court data).

- The Texas rules did not significantly affect judgment amounts or time to judgment. Third-party debt collectors and original creditors followed the same trends in judgment throughout the study period, despite third-party collectors being subject to additional evidentiary requirements after the passage of Rules 508.2 and 508.3.

- The rules did not have any significant effect on dismissal rates or the time to disposition.

Texas is one of several states that have enacted documentation reforms, although few laws are the same. This study presents a baseline of data against which to measure additional changes and to engage in further study. This study examines data available through court records, but more research, including an understanding of compliance with the state law changes, is needed to determine whether these laws have had their intended effect.