Third-party debt collectors and debt buyers dominate Oregon’s civil courts, few Oregonians participate in debt cases against them

David McClendon and Divia Kallattil • August 19, 2024

More than 50,000 Oregonians are sued for debt each year. In 2022, debt collection lawsuits comprised 52% of the state’s civil docket in circuit court— a share nearly three times that of eviction cases. These lawsuits can have a significant financial impact on the people sued, who are almost always navigating the system without an attorney. To understand the landscape of debt collection litigation in the state, the Oregon Judicial Branch shared seven years of court docket data with data scientists at January Advisors. Our analysis examines the characteristics of the parties involved in these lawsuits, disparities in who is sued, levels of defendant engagement, and case outcomes.

Most debt lawsuits are brought by businesses that specialize in debt collection and file cases in bulk. In Oregon, the top 10 plaintiffs represent more than half of all case filings and consist entirely of third-party debt collectors, debt buyers, and national banks. Oregon allows debt collection agencies, which do not own the debt but are collecting it on behalf of someone else, to sue in their own name, masking the original creditor. While other states have local banks, hospitals, or payday lenders amongst the top filers, in Oregon these creditors can hide behind private collection agencies. An analysis of documents from a random hand-sample of 1000 cases found the most common types of debt Oregonians were sued for were credit card debt, medical debt, and utility debt.

Oregonians who are sued for debt generally navigate complex court processes on their own: defendants are represented in fewer than 1% of cases. Our analysis found that 75% of cases are filed against people who make too much money to qualify for legal aid or to be protected from having their wages taken via garnishment. But most also don’t have the means to hire an attorney, pay the debt in full, or withstand the financial consequences of a garnishment.

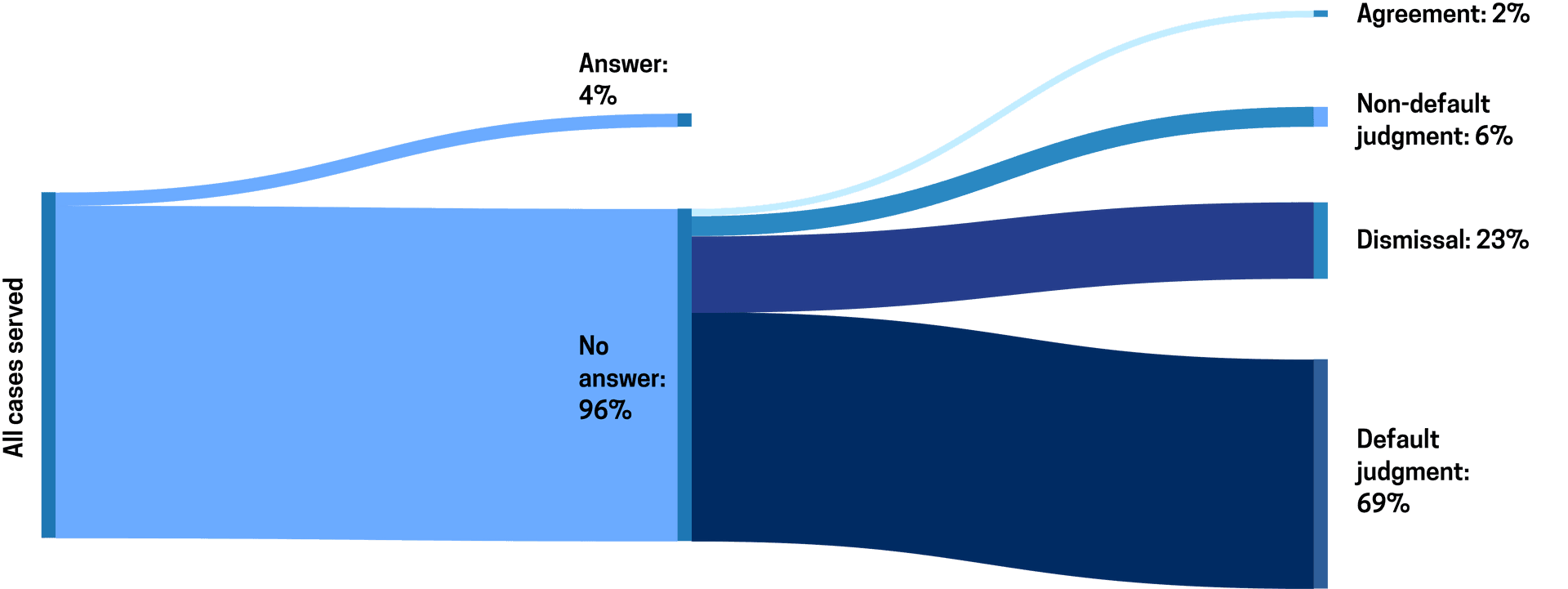

People sued must file a written answer with the court to move the case forward and avoid a default judgment, which is an automatic win for the plaintiff. But to do that they need to be able to make sense of the legal paperwork, understand how and what to file, and pay a filing fee. Faced with these barriers, fewer than 4% of people respond to the lawsuit against them, even though failing to engage can mean serious financial consequences that can follow them for years. Even if the case is not contested, the plaintiff can add legal fees – including a “prevailing party fee” that is unique to Oregon – and post- judgment interest to the amount in controversy, making it even more difficult to pay off. A judgment remains enforceable for up to 20 years and can result in the seizure of up to 25% of a person’s wages and some of the funds in their bank account.

Only 4% of Oregonians sued for debt respond to the case against them.

Percent of Oregon debt defendants who answer their case, and the outcomes for those who do not.

Source: Oregon Judicial Department, 2017—2023

This analysis details these findings and many others, showing the breadth of the challenges facing Oregonians who are sued for a debt and providing data to help the courts, policymakers, and advocates make informed decisions about the process and policy improvements they want to promote.