The Unequal Burden of Debt Claims: Disparate Impact in California Debt Collection Cases

Claire Johnson Raba • July 31, 2023

Cases filed in California courts to collect consumer debts disproportionately burden Black and Hispanic borrowers. Findings from a new study by Claire Johnson Raba, a researcher with the Debt Collection Lab, show the impact of consumer debt cases filed across five years in four of California’s most populous counties, Los Angeles, San Bernardino, Fresno, and Santa Clara. This study identifies patterns in how creditors collect defaulted debts using the civil legal system and provides new information about the demographics of unrepresented consumer defendants in state court.

Through an analysis of court records and census tract data, the report explores the impact that debt collection lawsuits have on geographic areas populated by low-income people. Data drawn from civil court records show that claims to collect defaulted consumer debts are filed at a higher rate against borrowers of color than against white borrowers. The type of creditor also varies by the borrower’s race and ethnicity. Store credit card issuers and sub-prime auto lenders file claims more often against non-white than white consumers, and the case outcome distribution shows disproportionately higher rates of judgments entered against these borrowers.

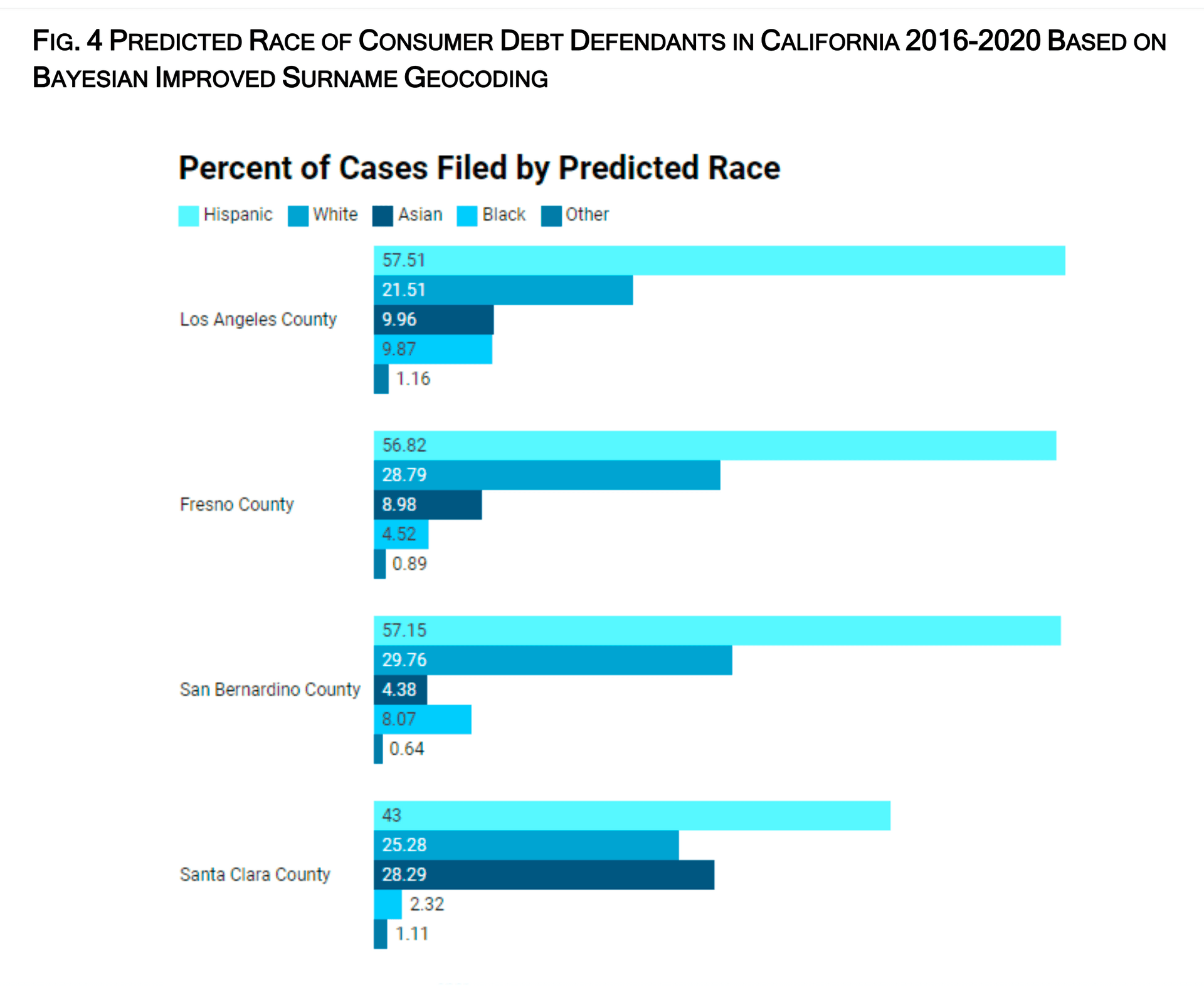

Using Bayesian Improved Surname Geocoding, this study uses address and surname data to predict the race and ethnicity of consumer defendants and then compares filing rates — at the county and census tract levels — to the racial/ethnic distribution of the general population (drawn from U.S. Census American Community Survey data). Defendants with Hispanic-predicted last names are sued disproportionately in all counties studied over the study period. Black borrowers are also over-represented in the court record data, while white and Asian borrowers are underrepresented. Black and Hispanic litigants are also less likely to be represented by an attorney. The distribution of case participation and outcome also varies by race, with fewer answers filed and more judgments entered against Hispanic and Black defendants.

This study examines where debt collectors sue in California to collect defaulted debt, mapping the prevalence of debt collection lawsuits by county and census tract, but debt collection lawsuits do not exist in a vacuum. They are the result of lending practices and the relationship between race and subprime lending of high-cost credit products is a likely driver of racial disparities in debt collection lawsuits. The findings in this study are intended to spur a conversation about debt collection claims and about the role of courts in a one-sided litigation system that disproportionately impacts communities of color in California.