One-Sided Litigation: Lessons from Civil Docket Data in California Debt Collection Lawsuits

Claire Johnson Raba • July 24, 2023

A new study by Claire Johnson Raba, a researcher with the Debt Collection Lab, shows that debt cases are an increasing burden on consumers and the civil court system. In an evaluation of collection cases filed against consumer defendants in California’s most populous counties, court record data shine a light on the high-volume creditor plaintiffs who file hundreds of thousands of cases each year against unrepresented consumers.

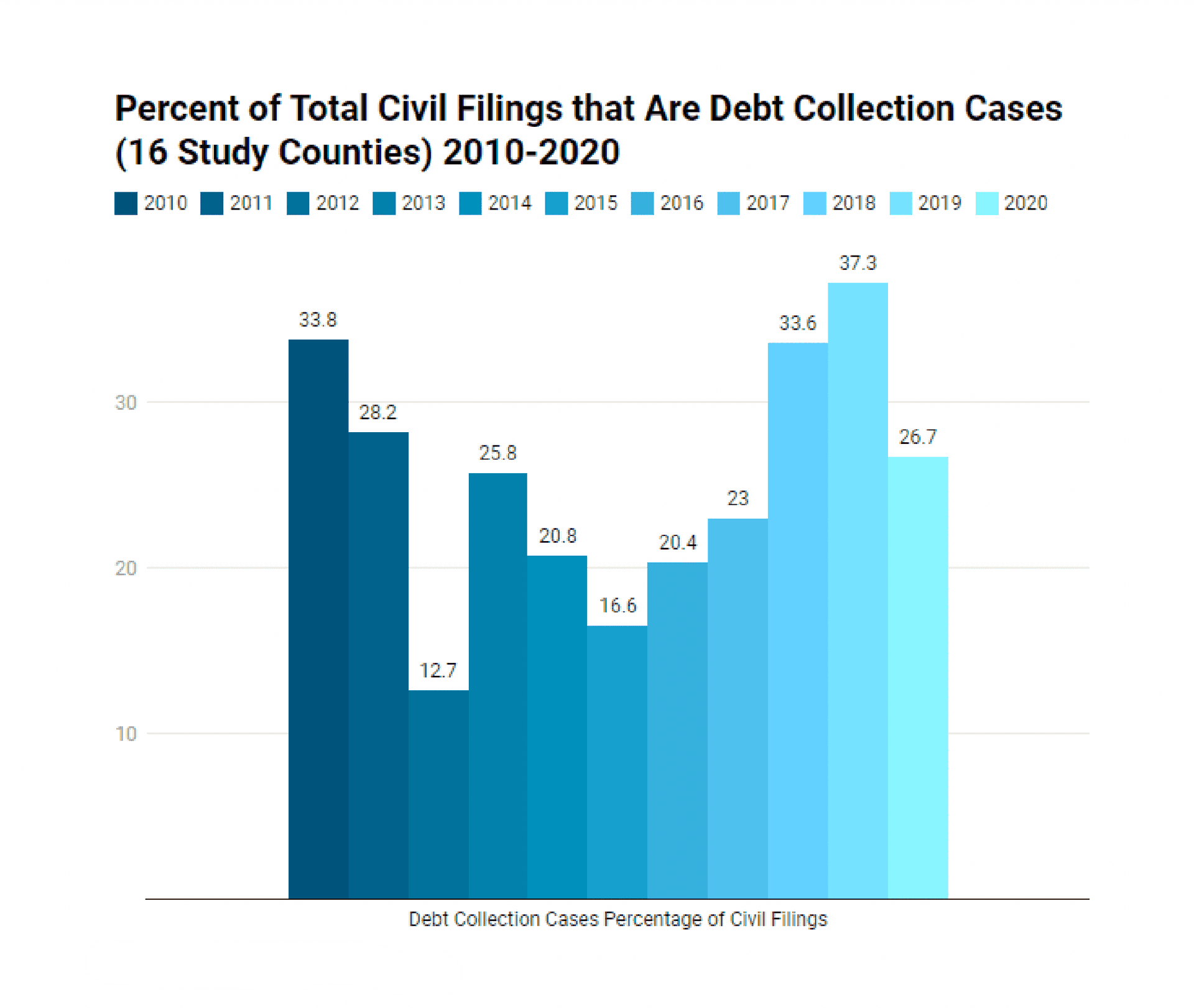

The Debt Collection Lab studied 2.2 million court records over an 11-year span from 2009-2020 to understand how debt collectors use the courts to obtain judgments against borrowers and collect payments on defaulted consumer debt. Debt claims comprised an average of 25 percent of the civil docket over the study period, with the proportion of debt claims on the rise since, making up 37 percent of the total civil docket in 2019 across the 16 counties studied.

Debt collectors are represented by lawyers, which means that under California law even very low dollar consumer debt claims are generally not heard in small claims court, but on the regular civil docket. This leaves consumer defendants attempting to understand and respond to complex processes of civil procedure and decode confusing forms in a state where 95 to 99 percent of defendants are unrepresented by an attorney. Lack of consumer engagement in debt collection cases in California means that the court system works only for creditor plaintiffs and their attorneys. In highlighting the practices of the repeat players who drive one-sided litigation in the courts, this report identifies high-volume litigation practices that lead to default judgments.

The findings show a strikingly low rate of consumer engagement throughout the court process, with consumers participating in the court process in less than ten percent of cases. For the repeat player creditor plaintiff, debt collection case filing trends over time reflect business decisions, but each of these 2.2 million cases is filed against an individual consumer defendant. For defendants, the court record data show that the court system is not accessible or available to unrepresented consumers. This one-sided litigation system excludes from the litigation process the voices, perspectives, and legal defenses of people sued to collect these debts.