Consumer Debt Collection Lawsuits in Wisconsin, 2018-2024

David McClendon and Divia Kallattil • December 17, 2025

Consumer debt collection lawsuits are among the most common cases in Wisconsin civil courts and appear to be on the rise in recent years, with nearly 100,000 cases filed in 2024 alone. These lawsuits involve unpaid credit card bills, medical debt, personal loans, utility bills, and other consumer debts, with a median judgment around $2,700 in Wisconsin.

The consequences of being sued in court can be severe, especially those living paycheck to paycheck. Court costs and attorney fees often get added to the original debt. Judgments can remain enforceable for years, following people as they try to rebuild their financial lives. Moreover, winning a lawsuit gives creditors the power to garnish up to 20% of a person’s wages or tap into bank accounts.

To understand the landscape of debt collection litigation in Wisconsin, the state court system shared seven years (2018 - 2024) of court docket data with data scientists at January Advisors. Our analysis examines who files these lawsuits, who gets sued, how cases end, and what happens after judgment. Below are some of the key findings and a link to the full chartbook.

National debt buyers and banks dominate case filings, and cases are on the rise across Wisconsin.

Debt collection lawsuits are largely brought by third-party debt collectors and debt buyers, followed by banks and credit card issuers. The top 10 plaintiffs in Wisconsin represent nearly half of all case filings from 2018-2024 and consist mainly of national debt buyers like LVNV Funding and Midland Funding, along with major banks like Capital One and Discover.

Case filings declined during the pandemic but have been rising since 2022, a pattern seen across the country.

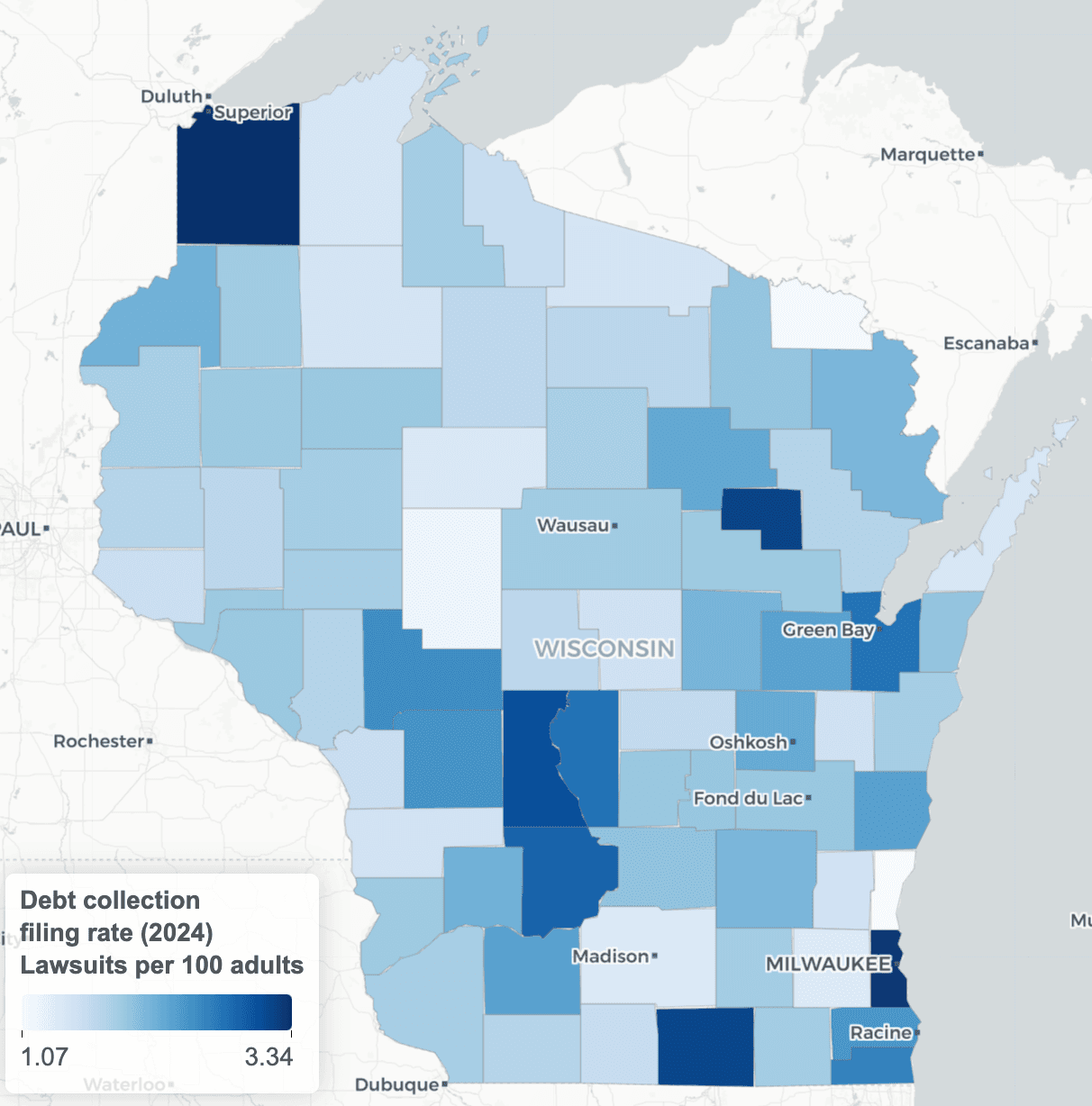

Debt collection lawsuits affect communities across Wisconsin, not just its urban centers. While Milwaukee County has the highest volume of cases, filing rates—cases per 100 adults—are also high in rural counties like Douglas and Menominee. Menominee County stands out: around 70% of the county’s population lives on the Menominee Reservation, and nearly half of residents have some form of debt in collections.

Medical debt lawsuits have dropped sharply and remain below pre-pandemic levels.

Medical debt lawsuits have decreased substantially since 2018, from around 30,000 annually down to 10,000 in 2023 and 2024, making up around 10% of cases filed in 2024. This trend is driven by a drop in filings among many of the largest hospital systems that once regularly sued patients. For example, Aurora Health Care filed 4,108 cases in 2018 but zero in 2024. Froedtert Hospital filed 2,553 cases in 2018 but none in 2024.

More research is needed to understand whether these providers are selling debt to third parties, expanding charity care programs, or changing collection practices in other ways. Wisconsin’s current data makes it difficult to identify cases of medical debt filed by third-party debt buyers and debt collectors.

Black and Latino residents are sued at higher rates, even after accounting for income.

Black residents are sued at 1.86 times the rate of white residents statewide. In Milwaukee County, the disparity is even starker: Black residents face 3.4 times the filing rate of white residents (6.2 vs. 1.8 cases per 100 adults).

These disparities persist across income levels, though they are most pronounced in the lowest-income neighborhoods. Even in higher-income neighborhoods, Black and Latino residents face nearly double the filing rates of white residents.

Most cases end in default judgment, and court processes vary by county.

About two-thirds of disposed cases in Wisconsin end in default judgment, which happens when the person sued does not participate in their case and the plaintiff wins by “default”. People sued for debt in Wisconsin rarely have legal representation—only about 1% of defendants have an attorney, while nearly all plaintiffs do.

Navigating the court process without a lawyer can be challenging for these consumers. Whether plaintiffs must personally serve defendants varies across counties and appears related to default rates: counties requiring personal service have lower default rates. Answer requirements also vary—some counties allow defendants to participate by appearing at a hearing, while others require a written response.

After judgment, about half of cases involve wage garnishment.

About 49% of judgments have an earnings garnishment notice in the court record. Garnishment occurs most often in default judgment cases (50% of default judgments) compared to other judgments (34%). In other words, when defendants participate in their cases, they are less likely to face wage garnishment—underscoring the importance of access to the courts and legal representation.

This analysis details these findings and others, showing the scope of debt collection litigation in Wisconsin and its effects on residents across the state. The data can help courts, policymakers, and advocates make informed decisions about process and policy improvements.